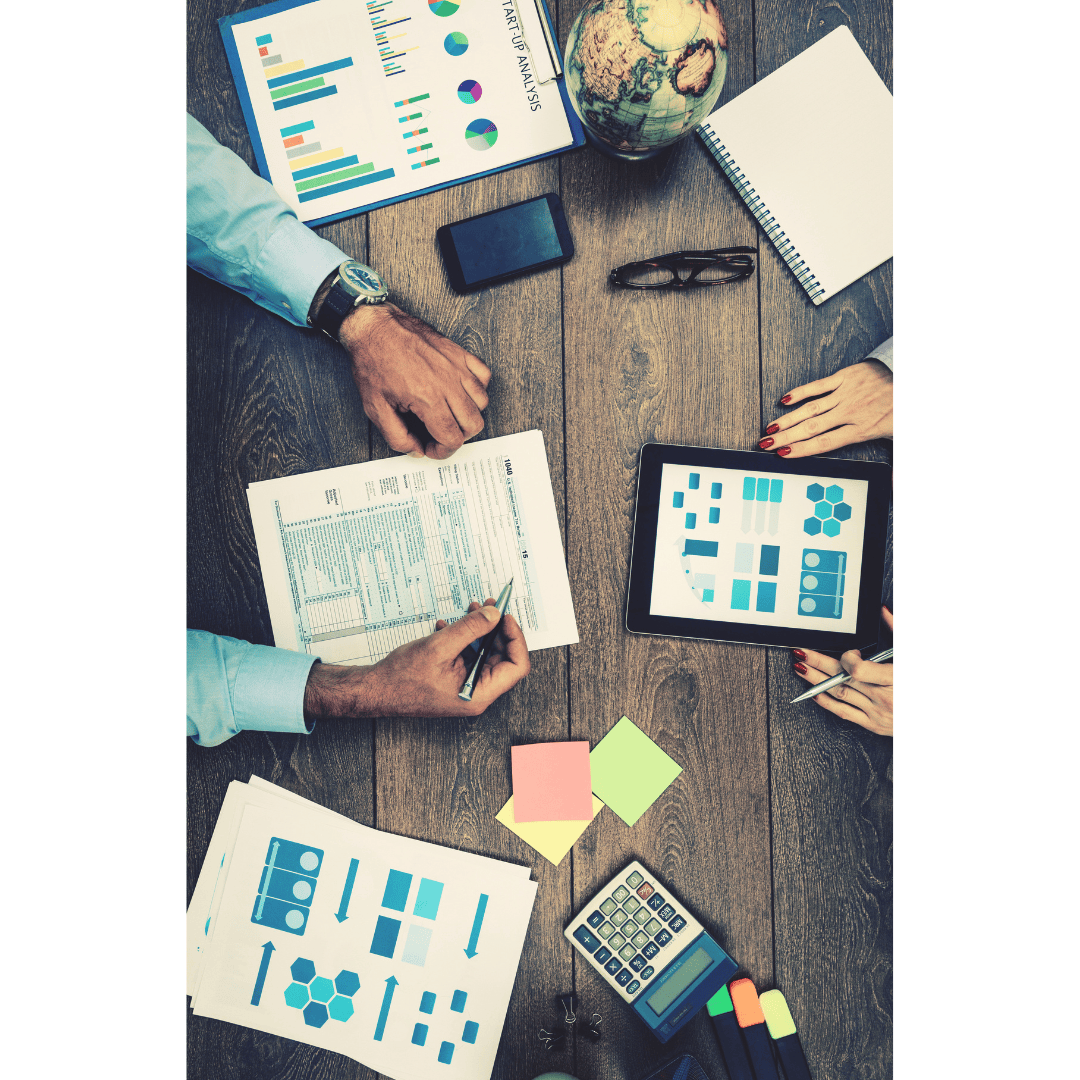

Federal and State Tax Filing

Accurate, Compliant, and Timely Tax Filing for Individuals Filing your federal and state taxes doesn’t have to be a burden. At [Your Company Name], we simplify the process with expert assistance, ensuring that every aspect of your tax filing is managed with precision and in accordance with all IRS and state guidelines. With our help, you can rest assured that you are not only compliant but also maximizing every available credit and deduction. What You’ll Receive: Personalized Consultation: Our tax experts take the time to understand your financial situation, ensuring that we capture all deductions and credits specific to your circumstances. Comprehensive Federal & State Filing: We handle both your federal and state returns, coordinating the details to ensure seamless filing across jurisdictions. Error-Free Filing: Our team uses advanced software and professional expertise to minimize errors, reducing the risk of audits or penalties. Ongoing Support: We’re available year-round to address any tax questions or updates you may need, not just during tax season.

Learn More